Esther Delignat-Lavaud Rodriguez Contributor

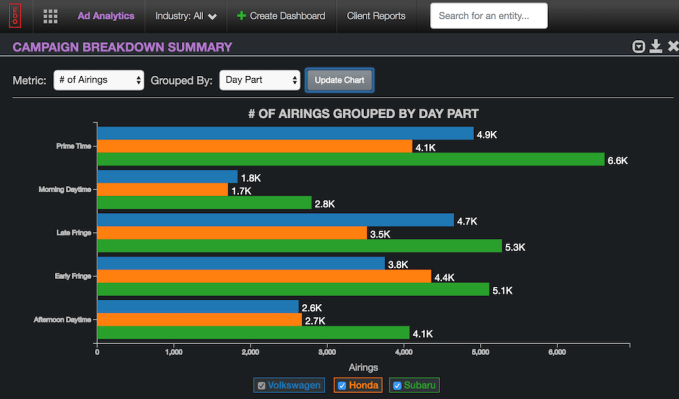

Cannabis-infused drinks. Burgers grown in laboratories. Entire meals in bottles. Consumers, retailers and farmers alike are hungry for the next generation of food, and investors are beginning to acquire the taste, too. Early-stage investment in agrifood tech startups reached $10.1 billion in 2017, a 29 percent increase on the previous year.

Agrifood can be split into two parts. “Agritech” refers to technologies that target farmers. “Foodtech,” by contrast, targets manufacturers, retailers, restaurants and consumers. Jointly, the two have enough reach to impact every part of the production line, from farm to fork.

Recently, foodtech investments have led the charge, with Delivery Hero’s IPO and multi-million rounds in ele.me and Instacart. However, agritech deals are catching up: Indigo Agriculture and Ginkgo Bioworks raised $203 million and $275 million, respectively.

There’s also more acquisitions activity in the sector. Some recently baked news suggests that both Uber and Amazon could be in talks with Deliveroo for a potential acquisition. Meanwhile, John Deere put $305 million on the table for the robotics company Blue River Technology, and DuPont acquired farm management software Granular for $300 million.

So why the growing interest in agrifood?

Food is a huge market, and it’s changing fast

Back in 1958, there were 3 billion of us on the planet. Today, population size has reached 7.6 billion, and is due to hit a whooping 11.2 billion in 2100. That is a lot of mouths to feed.

But the appeal of the food market doesn’t stop at volume. Indeed, following Bennett’s Law, as people’s income increases their diet becomes more diverse. This economic compulsion to seek variety is being complemented by a rise in ethical consumers voting with their forks. Many have grown aware of the link between food and ecology, health and animal welfare. The number of vegans in the U.S. has increased six-fold in the last three years, and more than tripled in the U.K. over the past decade.

This is not simply a case of having our cake and eating it.

These dual trends have led to supermarket shelves and restaurant menus evolving at pace. Consumers are keen as mustard to find new and healthy “superfoods” such as insects — Eat Grub and Cricke — and new consumption-forms, from meal replacement options like Huel to vegan meal boxes such as allplants.

When it comes to agritech, alternative production models have also arisen to cater to consumers’ preferences. Vertical farms such as GrowUp and LettUs Grow, for example, could dramatically reduce the environmental impact of farming.

Combining the above two ingredients — a growing population and a diversification in diet — cooks up quite the appetizing dish for investors: The global food and agriculture industry is estimated to be worth at least $8 trillion.

New technologies are creating big opportunities

The food and agriculture value-chain is full of bottlenecks and inefficiencies. Some of them could be solved with the intelligent application of well-known technologies.

The humble online marketplace, for example. Marketplaces, including Yagro, Hectare Agritech and Farm-r, let farmers transact machinery and goods, while peer-to-peer platforms like WeFarm enable knowledge sharing. Food procurement marketplaces have cropped up too, such as COLLECTIVfood, Pesky Fish and COGZ — as have direct-to-consumer services, such as Farmdrop and Oddbox.

Some tech solutions are far more complex.

Genetic engineering, for one, is providing plenty of food for thought. Indeed, the UN suggests that food production must increase by 70 percent by 2050 to feed the world’s population growth. Genetic engineering could increase crop yields by 22 percent globally, as well as help pre-empt pre-harvest losses.

To this end, CRISPR is revolutionizing how food is grown. CRISPR technology helps producers optimize photosynthesis and the vitamin content of crops. Since it was first tested on tobacco production in 2013, CRISPR has been used on a range of crops, from wheat and rice to oranges and tomatoes; and for a whole spectrum of applications — from boosting crop resistance to pests, to improving nutritional contents. CRISPR is also being applied to livestock. At the Roslin Institute in Scotland, researchers have successfully used CRISPR to develop virus-resistant pigs.

In the same vein, there have been major advances in cellular agriculture. Cellular agriculture combines biotechnology with food and tissue engineering to produce agricultural products like meat or leather from cells cultured in a lab.

It is easy to see how cellular agriculture and the companies applying it, such as Meatable and Higher Steaks, could dramatically change farming and food production.

Therefore, investors have thus been tempted to take a bite at the “clean meat” industry. In Europe, Mosa Meat just raised $8.8 million, while U.S.-based Memphis Meats raised $17 million in 2017.

Even though products are yet to hit the shelves, the appeal is clear: The meat market will be worth $7.3 trillion by 2025, with a 73 percent increase in demand by 2050. And clean meat technology could allow for the production of meat at virtually infinite scale: In just two months, 50,000 tons of pork cells could be grown per bioreactor by using starter cells from 10 pigs. This could dramatically reduce the production cost of meat, and also its environmental cost: 6x less water is needed and 4x less greenhouse gas is emitted per pound of clean meat compared to “traditional” meat.

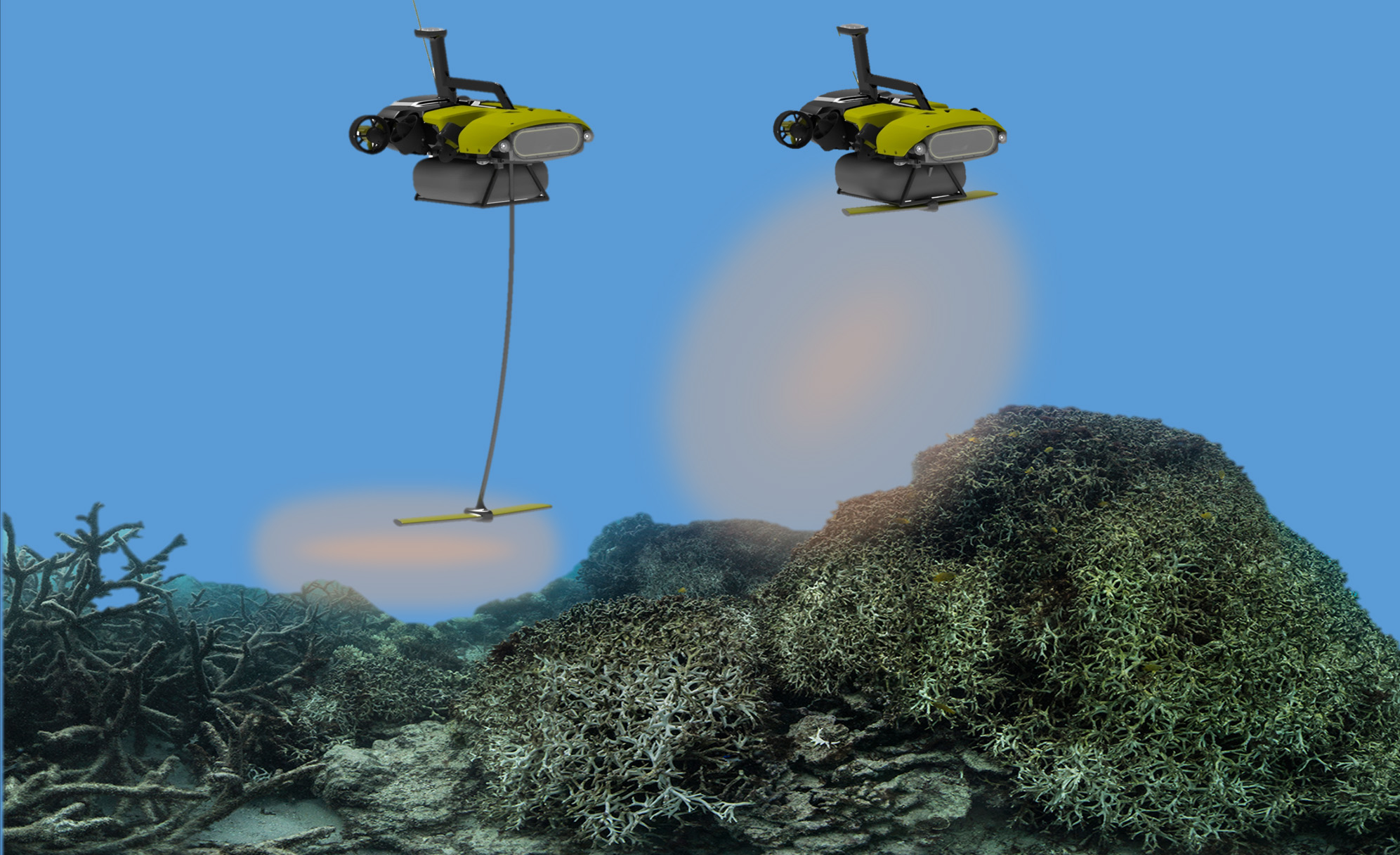

Artificial intelligence and machine learning is also impacting agriculture. One of the main opportunities, amongst many, is in precision agriculture.

Farmers now receive better information on crop status due to advances in image recognition, sensors, robotics and, of course, machine learning. Startups such as Hummingbird Technologies and Kisan Hub have developed solutions that outperform human “crop walks.” Similarly, Observe Technologies provides fish farmers with AI-powered insights to optimize feeding.

Consumer acceptance is also likely to be shaped by the economic, environmental and ethical implications of agrifood technologies.

Moving indoors, Xihelm (full disclosure, Oxford Capital is an investor) is developing a machine vision algorithm that enables roboticized indoor harvesting. Such technologies could help solve the labor crisis in agriculture: The 2017 labor shortage saw labor costs rise by between 9-12 percent in the U.K.

When the food moves from farm to retailers, supply chains can become unwieldy and difficult to manage. As a result, there is a $40 billion fraud problem in food. Blockchain technologies are being applied to solve this problem, powered by companies such as Provenance. Walmart recently announced that their leafy-green vegetable suppliers must upload their data to the blockchain, allowing them to trace food back to the source in 2.2 seconds instead of a week.

Agrifood tech is still an acquired taste

Although the agrifood market is huge and presents many opportunities for investment, it still isn’t quite the tech investor’s favorite dish. Yes, investment increased to $10.1 billion in 2017; however, fintech hit $39.4 billion in the same year.

There are several reasons. Digitization is growing, but it is slow. Farmers are understandably risk-averse. Their aversion is strengthened by the seasonality and fallibility of their activity. Most crops deliver produce once a year, so any missed harvest can have dramatic and long-lasting consequences. Implementing any large-scale technological solution represents a risk; therefore veering away from the status quo is a decision that cannot be taken lightly.

Regulation is a huge consideration for the sector. The Court of Justice of the European Union recently ruled that plants created with CRISPR must go through the same lengthy approval process as GMOs. In France in 2018, a law banned the use of terms like “meat” and “dairy” for vegetarian and vegan products — although it is not clear how this law will apply to cultured meat products in the future, nomenclature is a fight clean meat startups will want to win for the sake of consumer acceptance.

Consumer acceptance is also likely to be shaped by the economic, environmental and ethical implications of agrifood technologies. It is chastening to remember that agriculture employs one in four people in the global workforce, a large proportion of which are women.

The future of food could see unemployment issues in farming; large changes in livestock and feedstock production; and significant alterations in land management. Furthermore, gene editing is likely to benefit large corporations more than independent farmers — who could be put at risk.

This is not simply a case of having our cake and eating it. Instead, the ingredients need to be chosen with great care, or the “future of food” risks leaving a very bitter taste.

from www.tech-life.in